Introduction

In the realm of finance, the cost of capital is a fundamental concept that plays a pivotal role in determining a company’s financial health and investment decisions. It represents the price a business must pay to raise funds for its operations, expansions, and projects. Understanding the cost of capital is crucial for business leaders, investors, and financial professionals as it influences crucial decisions on capital structure, project viability, and overall financial strategy. In this article, we delve into the concept of cost of capital, its components, significance, and how it impacts the financial landscape.

Defining Cost of Capital

The cost of capital refers to the expense a company incurs to raise funds from various sources to finance its activities. These funds can be obtained from a combination of debt, equity, and other financial instruments. The cost of capital is often expressed as a percentage and represents the rate of return required by investors to invest in the company or the minimum return a company must generate on its investments to satisfy its stakeholders.

Components of Cost of Capital

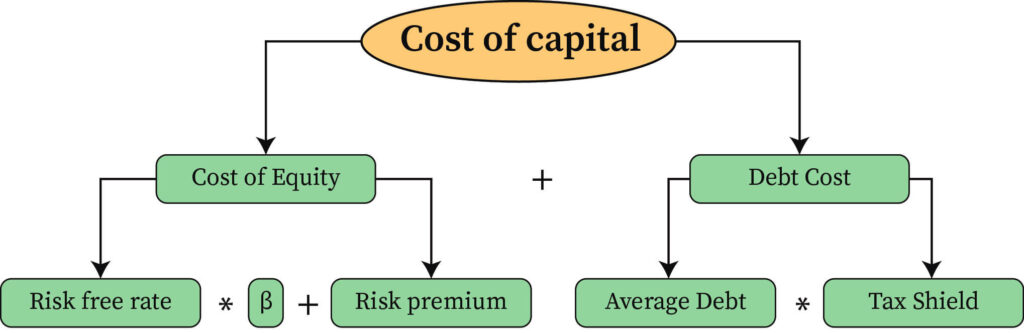

The cost of capital is composed of two main components:

- Cost of Debt: The cost of debt represents the interest expense a company incurs on its borrowed funds. It is calculated by considering the interest rate on the debt and any associated fees or expenses.

- Cost of Equity: The cost of equity refers to the return expected by investors who hold the company’s common stock. It represents the return required to compensate shareholders for the risk associated with their investment in the company.

Significance of Cost of Capital

The cost of capital is a critical metric with several important implications for businesses and investors:

- Capital Budgeting: Companies use the cost of capital as a benchmark when evaluating potential investment projects. If the return on a project is expected to be higher than the cost of capital, the project may be deemed viable and acceptable.

- Capital Structure Decisions: The cost of capital influences decisions related to the mix of debt and equity financing in a company’s capital structure. Balancing debt and equity can help optimize the cost of capital and maximize shareholder value.

- Investor Expectations: Investors use the cost of capital as an indicator of a company’s financial health and risk profile. Companies with a lower cost of capital may be perceived as more attractive investment opportunities.

- Business Valuation: The cost of capital is an integral component in valuing a company, especially when using discounted cash flow (DCF) analysis. The DCF method involves discounting future cash flows at the cost of capital to determine the present value of a business.

Factors Influencing Cost of Capital

Several factors can influence a company’s cost of capital, including:

- Economic Conditions: The overall economic environment, including interest rates and inflation, can affect the cost of debt and equity.

- Industry Risk: Companies operating in riskier industries may have higher costs of capital as investors demand a higher return to compensate for the increased risk.

- Financial Health: The financial health and creditworthiness of a company can impact its cost of debt. Companies with strong credit ratings may enjoy lower borrowing costs.

- Market Sentiment: Market sentiment and investor perceptions can influence a company’s cost of equity. Positive market sentiment may lead to a lower cost of equity, and vice versa.

Conclusion

The cost of capital is a crucial financial metric that helps businesses assess the price of raising funds for their operations and investments. Understanding the components and implications of the cost of capital is vital for making informed decisions on capital structure, investment opportunities, and overall financial strategy. Businesses and investors alike rely on this essential concept to optimize their financial decisions, maintain competitiveness, and maximize shareholder value. By continuously monitoring and managing the cost of capital, companies can navigate the complexities of the financial landscape and position themselves for long-term success and growth.